An Overview of ADC Therapeutic's in Oncology

Part 1: Exploring ADC functionality and an overview of FDA-approved oncology treatments

As part of the expansion from our “Exploring Drug Modalities: Small Molecules, Biologics, RNA, Cell & Gene Therapy” article, we have previously described how Chimeric Antigen Receptor (CAR)-T cell therapies are used to treat various types of cancer.

In this article, we will explore another modality in the arsenal of immunotherapies known as Antibody-Drug Conjugates or ADCs, discussing their application in cancer treatment.

We will look at the history of ADCs and overview of commercial activity, how they are designed, their mechanisms of action and an analysis of currently approved ADCs.

Brief history of ADCs and overview of recent commercial activity

With the global rise in cancer cases, many people are familiar with the disease and its treatment side effects, such as hair loss. But have you ever wondered why this happens?

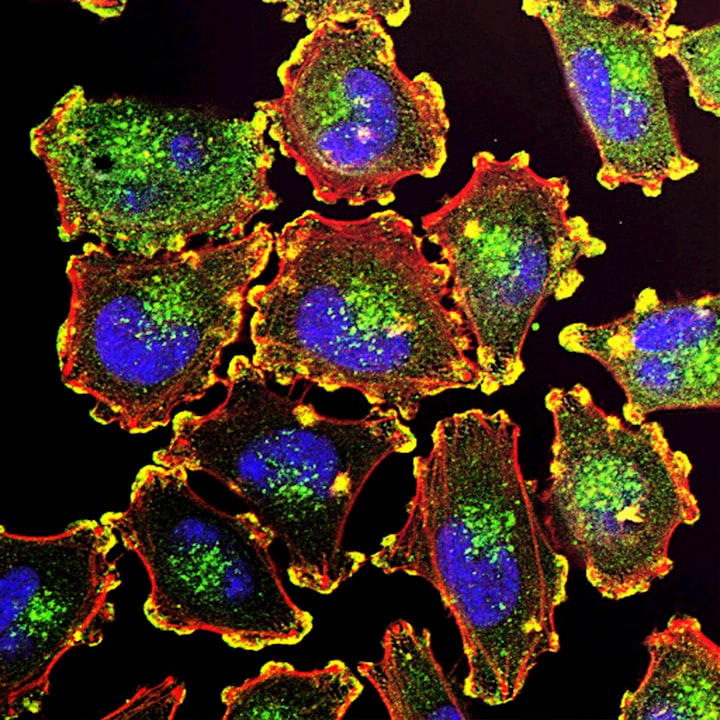

Hair loss during cancer treatment, also known as alopecia, is primarily caused by chemotherapy and radiation therapy, which target rapidly dividing cells. While these treatments are designed to attack cancer cells, they also affect other fast-growing cells in the body, including those in hair follicles. Since hair follicles are among the fastest-growing cells, they become unintended casualties of cancer treatment, leading to hair thinning or loss. Though hair loss is temporary in most cases, it can be a distressing side effect of the fight against cancer.

Put simply, chemotherapy attacks all the cells in the body when administered leading to killing of cells in an untargeted manner. And while chemotherapy is still one of best methods of fight cancers, researchers and scientists have been trying to find ways to make therapies more targeted to prevent unnecessary killing of cells, which not only results in hair loss but also brings with it many other undesirable side effects. This need for more targeted therapy led to the production of Antibody-drug conjugates (ADCs).

ADCs emerged from innovations in antibody therapeutics, driven by the need for more precise chemotherapy delivery. This approach sought to harness the specificity of antibodies to deliver cytotoxic drugs directly to cancer cells. The strategy culminated in the FDA's approval of the first ADC therapy, Mylotarg® (gemtuzumab ozogamicin), in 2000 for the treatment of acute myeloid leukemia (AML). This marked the beginning of a new era in targeted cancer therapies using ADCs.

By mid-2024, there were 12 ADC drugs approved for both hematological malignancies and solid tumors worldwide, with the majority of the ADCs (7 out of 12) gaining approval since 2019. Moreover, over 100 ADC candidates are in different stages of clinical trials at present. With expanding targets and indications, ADCs are leading a new era of targeted cancer therapy, expected to enhance conventional chemotherapies in the future across multiple cancer types.

In fact, if you have been following the news, it would come as no surprise that “Big Pharma” went on a buying spree from 2023 till date, acquiring 12 ADC focused biopharma entities (see table below). Apart from M&A’s the IPO market was also very active with approximately 6 ADC biopharmaceuticals going public in the last two year.

Major acquisitions and deals in the ADC sector (2016-2024)

Overall, the ADC market in 2024 is characterized by robust growth prospects, ongoing innovation, and a strong pipeline of products aimed at addressing various cancer indications. The acquisitions and deals done by large pharmaceutical companies highlight the interest in ADCs, as well as the expectations that ADCs will play a major role in the treatment of cancer moving forward. The combination of increasing investment, technological advancements, and a growing understanding of cancer biology positions the ADC sector for continued expansion in the coming years.

With that, let’s look at what ADCs exactly are and how they work.

What are ADCs and how do they work?

In recent years ADCs have emerged as therapeutic options not only for the treatment of hematologic malignancies – also termed as “liquid cancers” - but also solid tumors. Often described as targeted chemotherapy, ADCs consist of three major building blocks: antibody, linker and a drug/payload.

Antibody: The antibody gives the ADC selectivity through its specific binding to a target antigen. Upon binding, the antigen/ADC complex gets internalized, allowing to shuttle cytotoxic payloads into target-positive cells. It is noteworthy that some target proteins do not easily internalize upon ADC binding and are thus not pursued for ADC development. This explains for example why there is no ADC targeting CD20 as it does not readily internalize (however, CD20 has been successfully targeted through bispecific antibody approaches).

Linker: Various linker technologies have been developed over the years. Broadly, linkers can be categorized into cleavable and non-cleavable linkers:

- Cleavable linkers allow for payload release inside the cells and upon killing target cells, through bystander killing, their cytotoxic effects are extended to target-negative cells as well. This so-called bystander effect is often desired, in particular in heterogeneous solid tumors where many cells do not express the target antigen, but can still be effectively killed by released payloads. However, premature payload release (i.e. in the blood stream) can lead to toxicities such as anemia and neurotoxicity.

- Non-cleavable linkers provide greater stability in circulation and are thus thought to exert less toxicities compared to their cleavable counterparts. Upon internalization of the ADC, the antibody part gets degraded in the lysosome, while the payload remains attached to the linker. Although the payload is able to induce its cytotoxic effects in the target cells, bystander killing of neighboring cells is limited.

Payload: Currently, three classes of cytotoxic agents are used in approved ADCs:

- Tubulin-inhibitors, including auristatins (MMAE & MMAF) and maytansinoids (DM-1). Such agents exert their cytotoxic effects during cell division, and are thus particularly effective against actively dividing cells (i.e. cancer cells).

- DNA-damaging agents, including calicheamicins and topoisomerase 1 inhibitors (DXd and SN-38). Calicheamicins cut double-stranded DNA, which happens irrespective of the cell cycle-phase. In contrast, topoisomerase 1 inhibitors are cell cycle-specific and exert their effects during S phase of the cell cycle.

- Novel inhibitor: Protein synthesis inhibitor (PE38). One ADC contains a bacterial exotoxin, that inhibits protein synthesis, leading to apoptosis of the target cell.

Mechanism of action

The rationale behind the design of ADCs is that they have the potential to improve the therapeutic index of potent cytotoxic therapies by delivering them more selectively to tumor tissues with relative sparing of normal tissues. The primary mechanism of action of ADCs involves antibody binding to the target antigen on tumor cells, internalization of the ADC and release of the payload, which then exhibits its cytotoxic effect in target cells. The image below provides a visual explanation of what happens.

Analysis of currently approved ADCs

According to Evaluate, the ADC market is projected to grow from $10 billion in 2023 to over $30 billion by 2028. This surge is expected to be fueled by the rising sales of blockbuster ADCs currently on the market (see table below).

Enhertu, for example, is forecasted to achieve peak sales of around $14 billion by 2033. Additionally, estimates suggest that existing approved ADCs could generate approximately $20 billion in sales by 2027.

List of blockbuster ADC's currently on the market

Currently out of the 12 approved ADCs, 11 contain a cleavable linker (see table below). In addition, majority of the approved ADCs are either tubulin inhibitors (involved in cell replication) or DNA damaging agents. Various companies work on improved linker technologies that confer high stability in circulation, yet are efficiently cleaved for optimal payload release within the targeted cells.

FDA-approved ADCs

Looking ahead, with hundreds of ADCs in development plus companies continuing to innovate on two fronts, the linker and payloads, innovation is expected to drive the sector forward and its one we will be following closely. In our next article, we will look at some trends in the within the sector as various companies continue to explore improved linker technologies that confer high stability in circulation, yet are efficiently cleaved for optimal payload release within the targeted cells as well as potential new payloads which are being tested.

Please be sure to leave your comments or feedback below.

Disclaimer: All opinions shared in this deep dive are the opinions of the authors and do not constitute financial advice or recommendations to buy or sell. Please consult a financial advisor before you make any financial decisions. Biocompounding does not own shares in any of the mentioned companies.

Comments ()