Head-to-head in the space of proteomics: Quantum Si (NASDAQ: QSI) vs Nautilus Biotechnology (NASDAQ: NAUT)

What is proteomics?

During the expression of a protein-coding gene, information flows from DNA → RNA →protein. This directional flow of information is known as the central dogma of molecular biology. (Learn more about DNA and RNA in our previous articles.)

Proteomics, in simple terms, is the study of proteins. This includes studying the protein structure and function. At the cellular level, proteomics deals with topics such as –

1) which proteins are expressed?

2) when and where they are expressed?

3) what are their structures in both active and inactive states?

4) what roles do they play in the life of the cell?

5) how do they interact with other proteins and molecules?

There are three main approaches to studying proteins: mass spectrometry-based proteomics, affinity-based proteomics, and protein (peptide) sequencing.

In 2019, the global proteomics market was valued at $21,122.32 million and it is projected to reach $49,978.8 million by 2027, growing at a compound annual growth rate (CAGR) of 12.2% over this period (2020 – 2027).

If you like to find out more about market research on proteomics, read more at https://www.alliedmarketresearch.com/proteomics-market.

The affinity-based method (protein microarray solutions) generated the highest revenue in 2019 due to both instruments and reagent sales. The high usage of this technology was due to its ability to track protein interactions more efficiently when compared to other technologies. Also, affinity-based methodologies are cost-effective, although they are labor-intensive. Due to the clear benefits of this methodology over others, they are currently extensively utilized for primary screening in drug discovery and other use cases.

Current proteomic analysis methods are is time-consuming, incomplete, and expensive. As approximately 95% of FDA-approved drug targets are proteins, there is a strong rationale to understand the proteome better.

Let's deep dive into the frontiers of proteomics and analyze two companies working in this realm.

Introducing Quantum-Si & Nautilus Biotechnology

Quantum-Si (NASDAQ: QSI) was incorporated in 2013 and is based in Guilford, Connecticut. It has developed a single-molecule detection platform that enables next-generation protein sequencing (NGPS) and a companion sample preparation module that allows scientists to quickly and easily get the sample ready for sequencing. QSI’s technology is based on Edman degradation, and the company has added a technological spin to this method allowing for its exploitation at a large scale.

Nautilus Biotechnology (NASDAQ: NAUT) was founded in 2016 and is headquartered in Seattle, Washington. It has developed an end-to-end platform technology (Nautilus Platform) for quantifying and unlocking the complexity of the proteome. Nautilus’s technology is an improvement to the legacy technologies of mass spectrometry-based and affinity-based proteomics. The company has added a technology stack on top of the current methods that allows for even greater speed and efficiency.

A look at their technologies

Nautilus & its Protein Identification methodology via Short-epitope Mapping (PrISM)

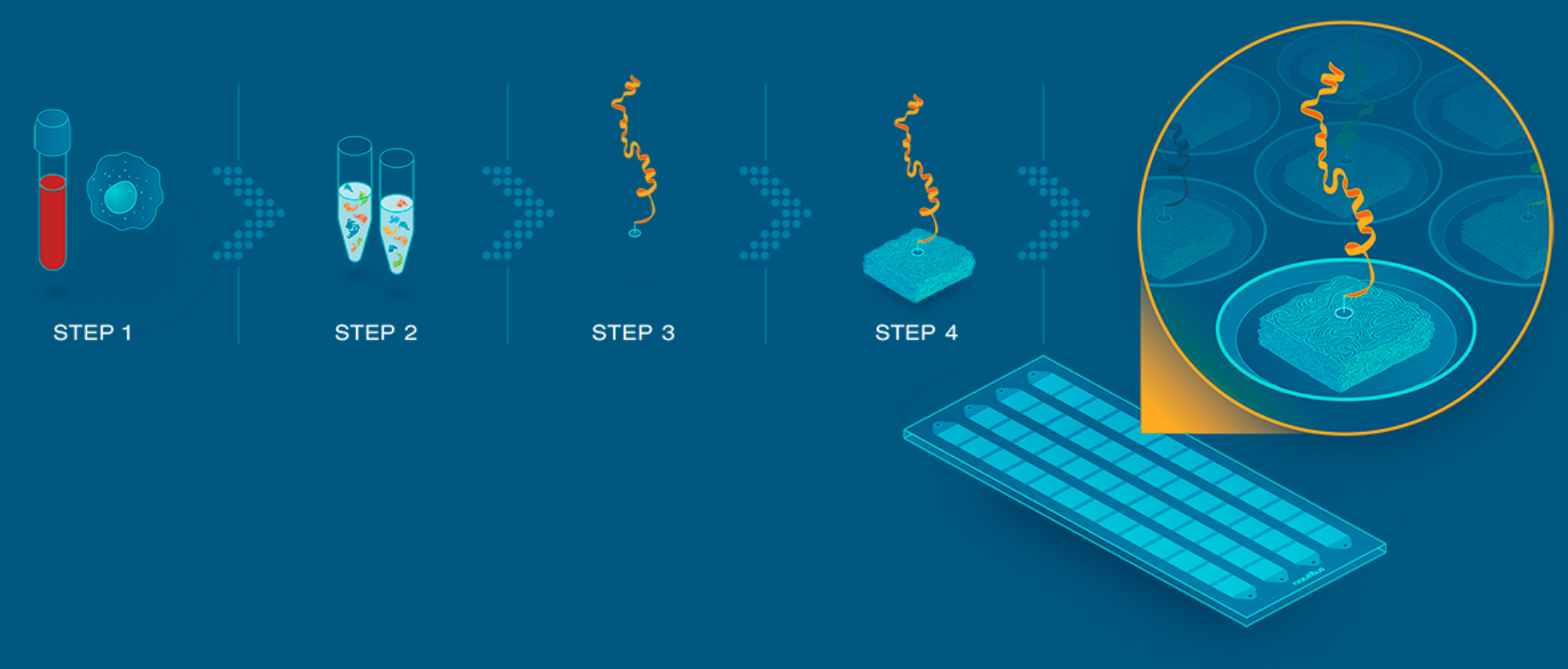

The Nautilus proteome analysis platform leverages a nanofabricated, large-scale, single-molecule protein array together with multi-cycle imaging, and machine learning analysis to identify and quantify the proteome with extreme sensitivity and scale.

First, individual intact protein molecules are immobilized via conjugation to proprietary scaffolds for deposition onto an array with billions of landing pads. Next, multi-cycle imaging allows repetitive, non-destructive probing of individual proteins with unique binding reagents (these are mostly antibodies). For these reagents, Nautilus has recently entered into a strategic development and supply partnership with Abcam to build reagents to augment internal capabilities. The results are digitized and analyzed to decode the proteome, potentially enabling quantitative analysis at an unprecedented scale.

Similarly, for diagnostics, the Nautilus proteomics platform looks to address a two-part problem. The first is the “needle in a haystack” ordeal of finding rare biomarkers, and the other is the availability of an assay sensitive enough to detect those biomarkers in low concentrations

One of the drawbacks of this system is that only known proteins with antibodies can be detected and analyzed. This means that the system cannot detect unknown proteins which might be present in the sample or proteome.

Quantum-SI & next-generation protein sequencing (NGPS)

Founded by the brain behind next-generation DNA sequencing, Quantum-SI is working to make the powers of single-molecule detection and NGPS broadly accessible as it was done for DNA sequencing two decades ago.

Next-generation protein sequencing is a push toward a fundamentally different approach to identifying and quantifying the protein mixture in complex biological mixtures. The technology, fluoro-sequencing by Edman degradation was designed to adapt the intrinsic features of single-molecule optical sensitivity and the massively parallel architecture from the successful next-generation DNA sequencing platforms.

This allows the features of high sensitivity, throughput, and digital quantification to be brought to the world of proteomics through peptide sequencing. The ability to successfully sequence the proteome will allow unknown proteins to be identified and studied to improve our understanding of the proteome. This will have profound implications for biological research and clinical applications as it will allow for the identification of new drug targets, biomarkers, transcription factors, and much more.

Does the company believe that the digital nature of the sequencing readout could enable users to answer three key questions: (1) What protein is present? (2) How much of the protein is present? (3) How has the protein been modified?

The main differences

Comparing purely based on technology, NAUT’s technology is analogous to microarrays in genomics while QSI’s protein sequencing technology is like DNA sequencing. In the field of genomics, both technologies still exist and sometimes they are mutually beneficial when they are used in tandem.

NAUT's affinity-based proteomic technology is an upgraded version of affinity-based protein detection (ELISA) with built-in computational analysis, making it faster and more sensitive. The platform can easily be curated to run personalized assays for individual test cases. But the company is highly reliant on third-party suppliers on providing reagents and antibodies.

On the other hand, NGPS is highly dependent on the protein quality but permits protein sequencing which allows for the detection and discovery of known and unknown proteins. One limitation is the limited readable peptide length, this would mean that additional computing power will be required to put the sequence back together similar to what is done for DNA sequencing. One method to do this would be to revert the sequenced peptide to its DNA form and compare it to the human genome which is fully sequenced to identify new proteins. In terms of cost, NGPS is also likely to be more expensive when compared to affinity-based technologies.

Competitive landscape

The below image shows that the proteomics field is getting increasingly competitive. In the affinity-based space, there is Olink and SomaLogic which are also listed, while in the protein sequencing space there is Encodia and Erisyon.

Closing words

Both NAUT and QSI are currently pre-revenue generating. NAUT has announced plans for the commercialization of its technology by the end of 2023. QSI on the other hand is forecasting revenue generation in 2022 and targeting to have an installed base of 534 instruments.

While both affinity-based and protein sequencing are essential to study the proteome, QSI is working on a novel technology that can have a significant impact on biology and understanding of the proteome which will allow for the development of new therapeutics.

Overall, both companies are still in their infancy and have a long journey ahead of them. We would thus ask interested investors to closely follow both companies and see which one is worthy of your investment in the next 6-12 months when their strategy and adoption becomes clearer.

Other information about the two companies

- Both are of similar size based on employee count (153 employers in QSI vs 119 employers in NAUT).

- They are both developmental stage companies working on their 'go-to-market' strategy with no concrete date to commercially launch their platforms.

- They both went public in 2021 via SPAC mergers - NAUT went public on NASDAQ on 10 June 2021 while QSI went public one day later on the 11th of June 202.

- As of June 2022, one year after their IPO, both shares are trading at roughly the USD$3/share mark (as of 13 June 2022, QSI is trading at $3.40 per share vs NAUT is trading at $3.07/share).

- Both companies are facing fierce competition within their field of expertise.

If you like articles like this one, please subscribe to our newsletter to stay updated with our latest articles.

Disclaimer: All opinions shared in this article are the opinions of the authors and do not constitute financial advice or recommendations to buy or sell. Please consult a financial advisor before you make any financial decisions.

Comments ()